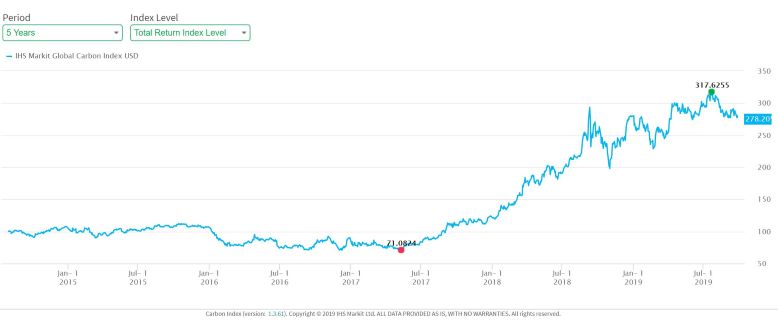

IHS Markit Launches World’s First Carbon Credit Index

IHS Markit has launched the world’s first Global Carbon Index in London on Sept 25. The international information provider unveiled its IHS Markit Global Carbon Index which became the first benchmark for the global price of carbon credits.

The IHS Markit Global Carbon Index was developed in consultation with Climate Finance Partners, a specialist in climate finance.

“The IHS Markit Global Carbon Index creates a valuable new benchmark for corporations, investors and financial services firms, all of which have to navigate the emerging but increasingly important markets for carbon credits,” said Sophia Dancygier, managing director and head of Indices at IHS Markit. “It also demonstrates our ability to apply our expertise in data, energy and other major industries and capital markets to develop unique products to address the most pressing and complex information demands within business today.”

The Global Carbon index will track the performance of the largest, most liquid and most accessible tradable carbon markets, namely the European Union Emission Trading System (EU ETS), the California Cap-and-Trade Program, and the Regional Greenhouse Gas Initiative (RGGI). The index is calculated using OPIS data and carbon credit futures pricing in those markets.

It will put a price on carbon dioxide emissions through cap and trade programs and other market-based mechanisms is a primary strategy for reducing carbon emissions. Worldwide, 57 jurisdictions have carbon pricing mechanisms, up 34% since 2017.

The new index is a part of firm’s solutions covering carbon markets, sustainable investing and corporate environmental, social and governance (ESG) needs. The firm’s Environmental Registry tracks the issuance, transfer and retirement of over 350 million carbon, water, and biodiversity credits. Last year, it launched a repository to collect, store and disseminate corporate ESG data, including carbon emissions.