Plug-In EV Make 8% of Market Share in Chinese Car Sales

No more support

No more support

There are reports that conventional car sales in China are contracting amidst trade tensions, a general economic slowdown and cooling consumer confidence. The Chinese automobile market contracted by 2.8 percent in 2018, marking the first annual decline in more than two decades. China’s Association of Automobile Manufacturers (CAAM) data shows, the production and sale of automobiles amounted to 27.8 and 28.1 million units, respectively, last year, following six consecutive months of declining sales.

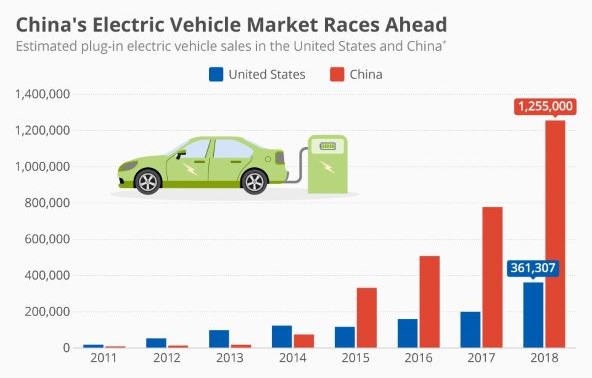

But then if we look at electric vehicle sales, the figures paints an entirely different picture. According to CAAM, sales of new energy vehicles, as plug-in electric vehicles and plug-in hybrids are referred to in China, grew by more than 60 percent last year, reaching 1.26 million units.

After a 3 month streak of record-breaking sales, plug-in electric vehicles (PEVs) in December just kept on pushing forward. China registered over 180,000 PEVs in December, making it the 4th record month in a row. That meant that 2018 sales ended north of the 1 million units mark. Yes, over 1 million PEVs in one year. And to think that 2017 was the first year that plug-ins reached 1 million sales GLOBALLY.

The PEV market share hit yet another all-time best, ending the month with 8% share. The 2018 PEV market share ended at a record 4.2% share, double the share of 2017 (2.1%), with sales expected to continue growing fast throughout 2019.

Foreign brands’ share of the PEV market was 6%, with Chinese brands absolutely dominating the sales. Of this small cake, 2 percentage points belonged to BMW, the best selling foreign brand, 1 percentage point belonged to Tesla, and 1 percentage point to Nissan, with the remaining manufacturers sharing the final 2 percentage points.

The top 5 spots was held by Chinese players- BAIC (EU, EC & EX series) and BYD (e5 & Yuan EV).

Looking at the manufacturer ranking, BYD (20%) was a comfortable winner, winning its 5th title in a row, while runner-up BAIC (15%) is finally profiting from a stronger lineup, now that it isn’t so dependent on one key player. In fact, BAIC could run head to head with BYD in 2019. BYD of course is also well known for its electric buses, and has a JV in India too.

The Chinese market for electric cars is more than three times the size of its U.S. counterpart, illustrating why it makes sense for Tesla to double down on its ambitions in what is still the world’s largest automobile market. December saw BMW(530e)and NIO(ES8) fight for the premium bestseller, in which Nio took the prize. However, BMW remained the best selling foreign brand in China. But GM with its Buick Velite 6 is entering the Chinese market in 2019 with 5000 pre-registrations and as is Tesla with an affordable Model 3. Now it remains to be seen what changes will following months bring in the rankings for 2019.