Clean Energy Investments Drop in First Half of 2019: BNEF

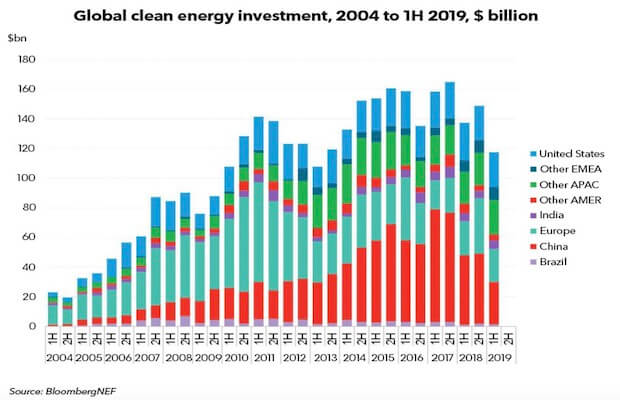

The first half of 2019 saw a 39 percent drop in clean energy investments in the world’s biggest market, China, to $28.8 billion, the lowest figure for any half-year period since 2013, according to the latest figures from BloombergNEF (BNEF).

The plunge in activity in China, as the country shifts this year away from government-set tariffs to auctions for new wind and solar capacity, also depressed the 1H 2019 global investment figure – to $117.6 billion, down 14 percent compared to the first half of 2018.

Justin Wu, head of Asia-Pacific for BNEF, said, “The slowdown in investment in China is real, but the figures for first-half 2019 probably overstate its severity. We expect a nationwide solar auction happening now to lead to a rush of new PV project financings. We could also see several big deals in offshore wind in the second half.”

While on the other end of the spectrum of global clean energy investment in the period was the financing of multibillion-dollar projects in two relatively new markets – a solar thermal and photovoltaic complex in Dubai, at 950 MW and $4.2 billion, and two offshore wind arrays in the sea off Taiwan, at 640 MW and 900 MW and an estimated combined cost of $5.7 billion.

Jenny Chase, head of solar analysis for BNEF, said, “Al Maktoum IV is an unusual one in combining three different types of solar – the thermal technologies of parabolic trough and tower, with conventional PV – but it is also a strong signal of the appetite for solar electricity on the part of both Middle Eastern countries and international financiers.”

The Dubai deal in late March, for the Mohammed bin Rashid Al Maktoum IV project, is the biggest financing ever seen in the solar sector. It involves $2.6 billion of debt from 10 Chinese, Gulf and Western banks, plus $1.6 billion of equity from Dubai Electricity and Water Authority (DEWA), Saudi-based developer ACWA Power and equity partner Silk Road Fund of China.

The two Taiwanese offshore wind projects, Wpd Yunlin Yunneng and Ørsted Greater Changhua, involve European developers, investors and banks, as well as local players. Offshore wind activity is broadening its geographical focus, from Europe’s North Sea and China’s coastline, toward new markets such as Taiwan, the U.S. East Coast, India and Vietnam.

BNEF’s figures for clean energy investment in the first half of 2019 show mixed fortunes for the world’s major markets. The “big three” of China, the U.S. and Europe all showed falls, but while the drop in the U.S. was a modest 6 percent at $23.6 billion and that in Europe was 4 percent at $22.2 billion, China took the biggest hit with its 39 percent setback.

Breaking global clean energy investment down by type of transaction, asset finance of utility-scale generation projects such as wind farms and solar parks was down 24% at $85.6 billion, due in large part to the China factor. Financing of small-scale solar systems of less than 1 MW was up 32% at $23.7 billion in the first half of this year.

Investment in specialist clean energy companies via public markets was 37% higher at $5.6 billion, helped by two big equity raisings for electric vehicle makers – an $863 million secondary issue for Tesla, and a $650 million convertible issue for China-based NIO.

Published with permission from saurenergy.com