UK-India Fund Commits Over £150 million for Country’s RE Platform

FDI in Renewable Energy Sector has been slow

FDI in Renewable Energy Sector has been slow

The GGEF yesterday announced its first investment into Ayana Renewable Power as part of a new partnership with CDC Group (the UK government’s development finance institution), EverSource Capital and the National Investment and Infrastructure Fund of India (NIIF). The investment is collectively worth £250 million(~Rs 2350 crore).

Ayana is a renewable energy platform which was launched by CDC in January, 2018 to develop utility scale solar and wind generation projects across India. According to a statement, it has a current capacity of 500MW of solar generation and a strong future pipeline of renewable energy opportunities. It further adds that the platform Ayana can play an important role in India’s ambition to build 175 GW of renewable energy capacity.

“I am delighted that the GGEF is making its first investment. GGEF is an India-UK fund anchored by our two governments under India’s flagship NIIF umbrella. It was announced by our two Prime Ministers at the Commonwealth Summit last year. GGEF’s investment in the renewable energy sector promotes the shared prosperity of both governments through climate finance, attracts more private sector investments to create jobs to catalyse India’s green growth,” said Dominic Asquith, UK High Commissioner to India.

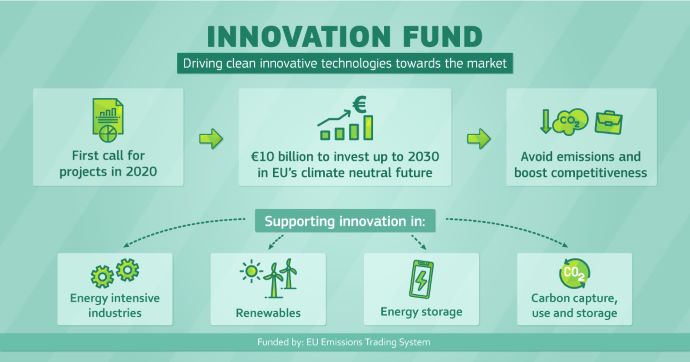

The Green Growth Equity Fund (GGEF) is a joint UK-India fund, designed to promote sustainable energy projects. According to the statement, the two countries have invested over £240 million (Rs 22.5 billion) of anchor capital into the fund, which is expected to raise up to £500 million (Rs 47 billion) from institutional investors. The platform will provide a conduit for international institutional investment, into green and renewable infrastructure projects in India.

UK’s London Stock Exchange has nearly 80 green bonds listed on it and green finance is one of the areas where India and the UK are cooperating. In The last two years, Indian companies have raised over £5.6 billion (Rs 525.5 Billion) on the LSE through masala, dollar-denominated and green bonds. These issuances have generated finance for Indian infrastructure projects including in railways, roads and renewable energy.